Investment in the cleantech industry has seen major growth in the San Francisco Bay Area over the last decade, jumping from less than half a billion in venture capital dollars to $3 billion, according to figures from the State of the Valley conference in February. Yet, a closer look at local cleantech investment trends reveals that investment peaked in 2008 and has been declining since then.

Peninsula Press tracked the number of cleantech startups in the San Francisco Bay Area listed on the startup-insider website CrunchBase. The site, originally an extension of TechCrunch, catalogs startup companies across the globe, tracking their activity, funding rounds and funding dollars.

CrunchBase compiles its dataset using a combination of sources: crowdsourced information from 90,000 online contributors, portfolio data from venture capitalist partnerships and web crawls of investment regulatory filings, social media and news sources, according to CrunchBase analyst Mark Lennon.

“We tend to be pretty comprehensive,” Lennon said. “We don’t miss a whole lot.”

When it comes to CrunchBase’s tracking of the San Francisco Bay Area cleantech market, there were 143 active local cleantech startups receiving some form of external funding on the site as of January, from small companies with fewer than 10 employees to giants like Tesla Motors and SolarCity.

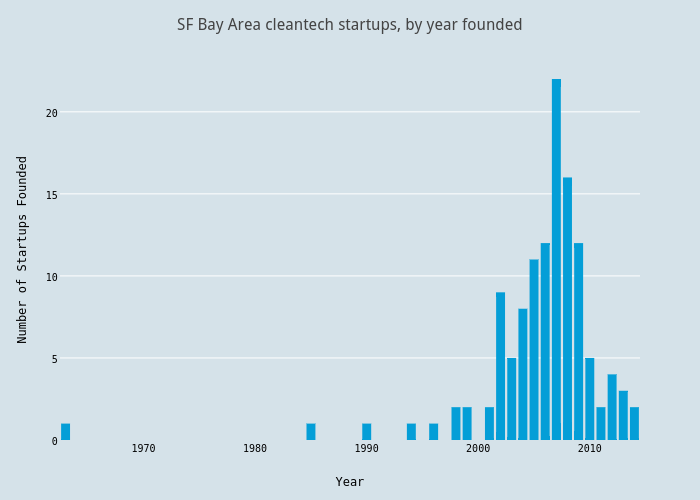

Yet, more than half of these startups — 73 companies — were founded between 2005 and 2009. Far fewer startup cleantech companies cropped up subsequently — just 16, according to Peninsula Press analysis.

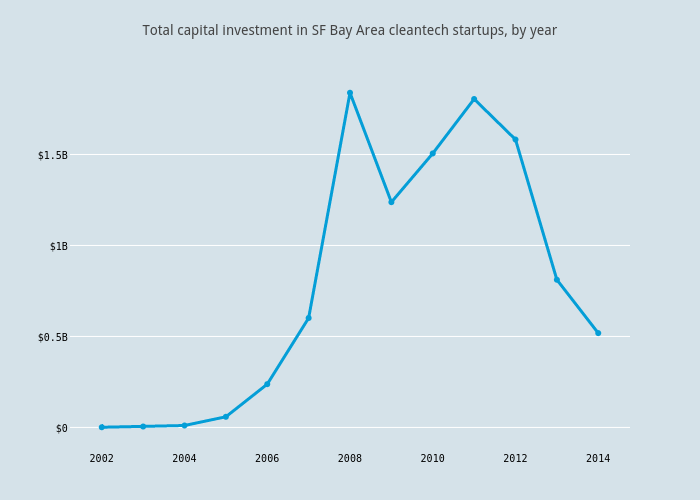

In 2008, $1.83 billion in capital investment poured into the area’s cleantech startups. For several years, investment in cleantech hovered at just above $1 billion, but in 2013, it dropped to $812 million. Last year’s numbers continued to decline.

Capital investment accounted for in this analysis includes venture capital, seed funding, private equity, debt financing, grants and all other forms of monetary investment.

When it comes to funding, a handful of heavily funded cleantech startups have the lion’s share of the investment money: the median in cleantech investment dollars is around $14 million, while the average skews much higher around $77 million. To put this in context, the top 10 companies make up only about 7 percent of listed cleantech startups, yet they hold over 61 percent of cleantech investment dollars.

This data set accounts for funded cleantech startups, yet there are many non-funded cleantech startups also listed on the site. Some local cleantech companies get going on their own, without external investment.

Rich Goebel, owner of FreeCleanSolar.com, launched his cleantech company in 2008, after years working on venture Internet startups in the late 1990s during the dot-com boom. FreeCleanSolar.com designs and sells solar power systems, while providing expert service to help customers implement solar power at the lowest possible cost. The company is listed on CrunchBase but displayed as without external investment.

“I started the business with my own nickel, and grew it organically,” said Goebel, who has never used investment capital to support the company. “When you start a business, and you start it on your own, you have to make money from day one.”

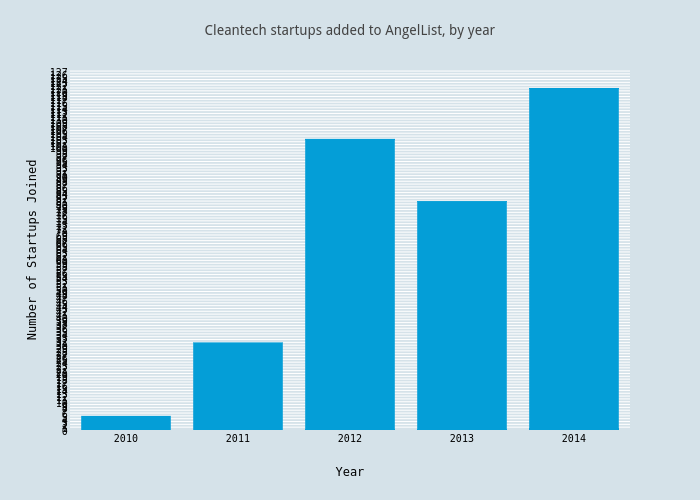

Goebel has also listed FreeCleanSolar.com on the startup crowdfunding site AngelList, which connects early-stage, pre-funding startups looking to fundraise with potential angel investors (and some venture capitalists that peruse the site). Since AngelList’s founding in 2010, the trend in number of cleantech startups in the Bay Area listing themselves on AngelList has slightly slowed. The largest increase in new cleantech startups listed occurred between 2011 and 2012, with dips and slower growth in subsequent years.

Goebel says he created an AngelList profile for FreeCleanSolar.com with little expectation of earning investment. Instead, the company exists on AngelList “just because,” Goebel said, explaining the site also holds social value and serves as publicity for his company.

For entrepreneurs like Goebel, cleantech is a smart industry to enter, with or without external investment.

A moral call-to-action in the face of climate change ensures some consumer interest, Goebel said. But because cleantech innovation is helping people save money on energy bills, it’s “smart economics” of cleantech that will continue to drive the industry’s success more than anything else, he added.

“I have always said that the only green the American homeowner cares about is the green in their wallet,” he said.