For many homeowners in California where headline-making wildfires have burned homes, led to power outages and caused billions of dollars in damages, getting property and casualty insurance becomes a key challenge.

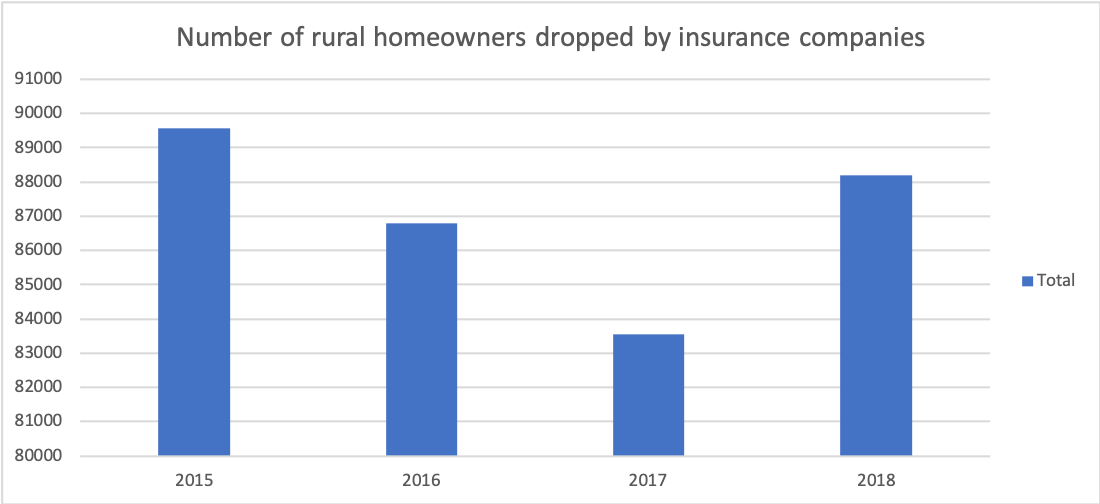

Last year, insurance companies decided to drop fire coverage for over 88,000 residents in California after a disastrous wildfire season, a 6 percent increase in non-renewals compared to 2017. According to data provided by the California Department of Insurance, between 2015 and 2018, nearly 350,000 rural homeowners lost wildfire insurance, being forced to find replacement coverage, which end up at much higher premiums.

For the past two years, insurance companies have paid $25 million in claims. Increasing fire risks will make insurance premiums continue to rise, according to former California Insurance Commissioner Dave Jones.

“Insurance companies can’t take the losses,” Jones said. “Rates have already been going up. This year will be higher, and the year after will be even higher.”

Jones said insurance companies have no choice as the underlying risk is so high.

“Insurance is the indicator of the risk and you can’t pretend the risk doesn’t exist,” he added. “The state government should continue to reduce the fire risk.”

As fire coverage is mandated by many banks and lenders, homeowners who carry mortgages have no choice but to buy more expensive insurances such as the California FAIR Plan, the state’s industry-funded fire insurer of last resort. According to real estate experts, the insurance crisis may further result in home prices cooling in some areas.

“You really need to know where to buy [homes],” said Ellie Kravets, senior lead agent of real estate brokerage Redfin. “This is very important because they [fires] will definitively change the price.”

“Property prices in some areas will go a little bit down. Houses in the flood zone or fire zone will definitely be less expensive,” Kravets said.